This post contains product affiliate links. These are mainly on items/hotels/tours that I personally endorse & love. I may earn a small commission if you make a purchase, but at no extra cost to you.

Do you want cheaper bike insurance for your travels? Then follow these simple steps to get a lower quote every time.

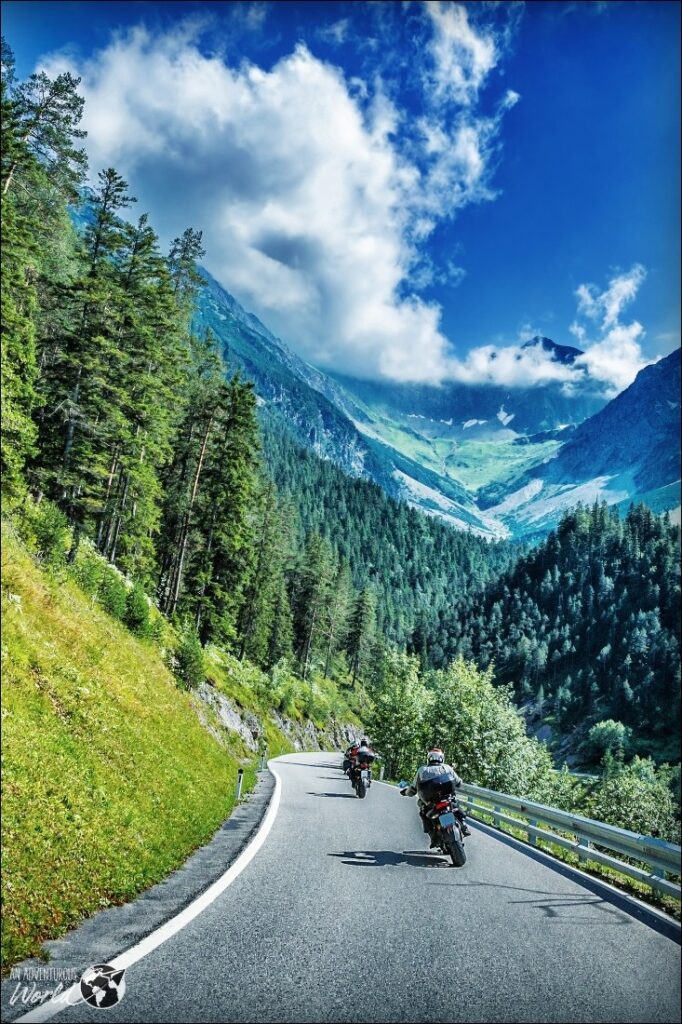

When I first went to Vietnam in 2009, I’d planned such an epic adventure. Like so many other backpackers at the time, I got completely caught up in the Top Gear episode where they buy motorbikes and ride the length of the country. I was like: “that’s me, that’s how I’m going to explore Vietnam.”

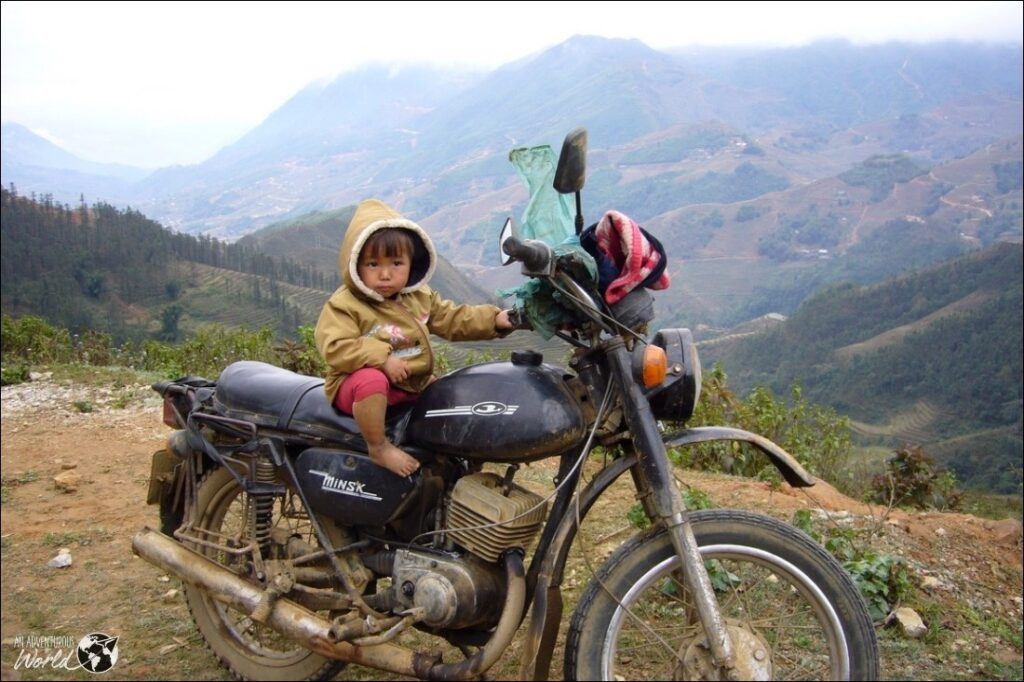

When I arrived in Ho Chi Minh City, after a few customary “Good Morning Vietnams!”, I looked at buying a bike. In Vietnam there are lots of old Minsks lying around. These are former Soviet-era bikes that date back to the 1950s (not all of them are as old as that).

At the time they only cost about $300-$400. A lot of backpackers would ride north to south, and then sell the bike to another backpacker like me riding back up north again. Essentially, you could buy a Minsk for $300 and sell it for around the same price, so free travel (minus all the breakdown costs and petrol of course).

Well, the only think that stopped me from buying a bike and doing that trip was insurance. There was no way my travel insurance was going to cover it if anything went wrong, and I couldn’t get bike insurance either. This is such a classic travel mistake!

Eventually the head caught up with the heart and I had to park that adventure. In the end I just took the bus and train like so many other travellers.

I still think about that trip a lot though, the what-ifs. I would absolutely love to do that trip again, this time with a bike. And obviously I’d make sure I had bike insurance this time around!

If you’re looking at getting cheap bike insurance for travelling, then here’s how to do it. Follow these simple steps and you’ll get a lower quote.

Contents:

1. Pay a higher voluntary excess

Choosing to bear a larger portion of the cost in the event of a claim can lead to more economical insurance rates.

Voluntary excess is the figure you agree to pay out-of-pocket if you’re involved in a motorbike incident. In such cases, you’ll need to pay this agreed sum before your insurance provider contributes.

This strategy can result in lower insurance payments on a monthly basis. You benefit from immediate lower premium costs, but there’s a risk of facing higher out-of-pocket expenses in the event of a motorbike accident.

Why would you do this? Well, if you’ve been riding for 10+ years and you’ve never had to make a claim, then you’ll know that accidents and crashes rarely happen. If you think you’re a good rider and haven’t had to make a claim before, then paying a higher voluntary excess can be a logical thing to do to get a lower quote.

2. Compare bike insurance

The best way to save money is to get a good deal through bike insurance comparison.

Don’t settle for less by automatically renewing with your current insurer each year. Instead, exploring different motorbike insurance quotes can lead to a cheaper renewal price, offering you better value for money.

As with any insurance, every year you should look around and get a few other quotes to make sure you’re not over-paying.

3. Estimate your annual mileage precisely

How often you use your motorbike severely impacts your insurance. It’s key to assessing your risk level: the more you’re on the road, the more likely you are to be in an accident. Makes sense, doesn’t it?

To accurately project your annual mileage for motorbike insurance, consider this approach: track the distance you ride for one month and multiply by 12 to estimate the yearly total.

While this method is useful for those with regular riding patterns, remember it might not fully account for extra rides during holidays or when you’re away.

Being precise in your mileage projection is crucial. It helps avoid the risk of invalidating your policy and ensures you’re not overpaying for your motorbike insurance.

4. Make your bike more secure

Improving your motorbike’s security can make a big difference to insurers.

By showing you’re serious about keeping your vehicle safe, you may be afforded cheaper premiums. Use a quality cover to hide your bike, which can deter thieves by making it less visible or attractive.

You could even install a high-quality alarm system or immobiliser to prevent thieves from moving your bike to a different location. Another smart idea is hiding an Apple iTag or Tile in the luggage compartment. That mean, it means if it is stolen, you can track it via your app. If you’re looking at getting cheap bike insurance for travelling, then this is particularly important.

When at home, use a ground anchor fixed to a wall or floor to secure your bike with a chain and padlock: this is particularly effective in garages or other indoor storage areas.

5. Become a more qualified rider

Go beyond basic riding skills and invest your time in additional qualifications.

Advanced rider courses focus on aspects like handling your bike in different weather conditions, improving road positioning, and developing observational skills to better anticipate risks.

By honing these skills and becoming a safer rider, insurers may recognise you as a reduced risk. The DVSA offers several recognised training courses, like the Enhanced Rider Scheme.

Other well-respected certifications, like the IAM RoadSmart and RoSPA’s Advanced Riders and Drivers course, will help lower your premiums over time.

6. Settle for annual insurance payments

When deciding how to pay for motorbike insurance, you have two options: monthly or annual payments.

Monthly payments offer budget flexibility but may be slightly more expensive over time. Annual payments, while requiring a higher upfront cost, can lead to savings as insurers often provide discounts for lump-sum payments.

The best choice depends on your financial situation and riding habits. If you can afford it and want long-term savings on your motorbike insurance, annual payments are the way to go.

If you’re planning a trip, don’t forget to check out my healthy travel tips before you go. This post could really make or break your trip, so give it a read!